Three Types Of Must-Have Insurance Coverage

If you are like most people, you probably bought your car insurance because it was required by law. Maybe you are a planner who understands the value of protecting your loved ones and your finances. You hope you never have to use it, but do you know what your policy covers should you become involved in an accident?

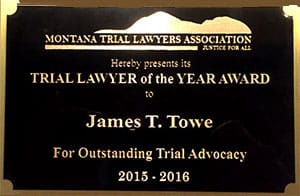

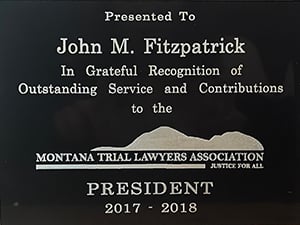

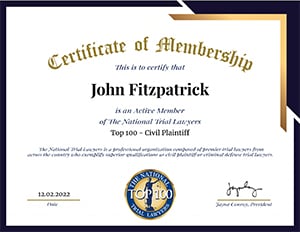

At Towe & Fitzpatrick, PLLC, we encourage you to understand the coverage you are paying for monthly or upon renewal. Why? If you are involved in serious accident, you may be entitled to compensation for medical bills, lost wages and pain and suffering, but who pays?

The Obligations Of Insurance Companies

Insurance companies have deep pockets and the ability to cover large compensation awards, but when they have a way out of paying, they will take it — like when you or the at-fault driver has insufficient or no coverage. You can always go after the other driver’s assets, but an individual driver doesn’t have the same resources.

Were you injured? We’ll fight for the maximum compensation you are entitled to and work to ensure that you get paid. Call us at 800-639-7106 or email us for a free initial consultation.

Many types of insurance may apply to a claim arising from a motor vehicle accident. Below are three types every driver should know about and have:

1. Liability Insurance

Montana, like most other states, requires that drivers have liability insurance. This ensures that any damage caused through negligence will be covered in the event of an accident.

2. Medical Payments Coverage (No-Fault)

Another type of auto insurance is medical payments coverage. It will cover the cost of any necessary medical care that you need if there is an accident, up to a predetermined amount based on your insurance plan. This is not dependent on who is at fault and even covers you if you are injured as a pedestrian. Generally inexpensive, it is a good idea to enroll if you have the option.

3. Uninsured (UM) And Underinsured (UIM) Motorist Coverage

Not all drivers in Montana carry legally mandated liability insurance. This means that if an accident is caused by their negligence there is no insurance company to pay for your damages. This is where uninsured motorist (UM) and underinsured motorist (UIM) coverage comes in. Insurance companies in the state are required to offer uninsured motorist coverage for purchase.

If an accident does occur with someone driving without insurance illegally, or if their insurance would not cover the extent of the medical bills or damage, UM or UIM coverage will kick in and pay the remaining balance.

An Ally Standing Up For Your Rights

Even though your own insurance company pays you for UM and UIM coverage, it still looks out for its bottom line first. The adjuster for your own insurance company is trained to make the best deal for the company. You should have a trained professional make sure you get the best deal for you.

Like medical payments coverage, UM and UIM will cover you even if you are not in one of your insured cars when you are hurt in an accident. To learn more, call 800-639-7106 or reach out via our online form.